One of the most oft-quoted, yet rarely adhered to pieces of advice must that History never repeats, but it rhymes. It’s a most interesting fact of life that we could learn the most about things by looking at what has happened in the past. Yet it seems we never do, and I include myself in that. Let’s start though by looking at a story :-

A major incident occurred, something that made world stock markets fall by over one-third in days. Governments, businesses and people panicked. In the aftermath, the law pertaining to buying property was changed and this resulted in a boom where people desperately tried to register their property transactions before a given deadline to take advantage of a tax saving.

Sounds like the Corona crash of 2020, followed by the UK government decision to temporarily abolish stamp duty on property transactions to get the economy moving, doesn’t it? Except it’s not. I’m actually referring to the 1987 stock market crash and the decision to limit and reduce MIRAS (Mortgage Interest Relief at Source) on mortgage repayments for property transactions made before a certain date, that got people in a property buying frenzy as the 1980s drew to a close. To take it further, that tax saving that people thought they were getting made them completely forget that they were overpaying in a frenzy in the present and that they just needed to be on the ladder at any price, before the ladder got pulled up forever on the deadline date.

Here, I can add my own piece of history to this, in buying my first house in Brighton in 1995. I actually met people who had been involved in that party and were living with the hangover every day. One, my manager at the time, had bought a property with a friend in 1988 in Eastbourne and they were stuck letting it out at a loss every month, hoping the price would get back to a point that they could cash out and take the loss. He also added that they weren’t really friends any more, to add to the pain. Another told me that he had sold his house in a nearby small town, Lancing and taken a loss, but he was now buying a house in Worthing. This guy helpfully also gave me some hope by telling me he felt that the crash was over and that now was a great time to actually be buying a house, if you had the opportunity to, as so many were bogged down by their recent mistakes. He was right. Looking back, the older me has no idea how someone aged 24, living on their own and earning an average salary for the time could possibly afford a three-bedroomed 1920s house with a garage. Yet that’s what I got. Let’s add in that the mortgage rate was 5.99%, fixed for 3 years and that was considered reasonably cheap, for the variable rate was about 8-9% and it had been even higher just a few years previously. When I moved into that house, purchased for under £55,000, a neighbour told me that some nearby had sold for £100,000 before the punch bowl got taken away.

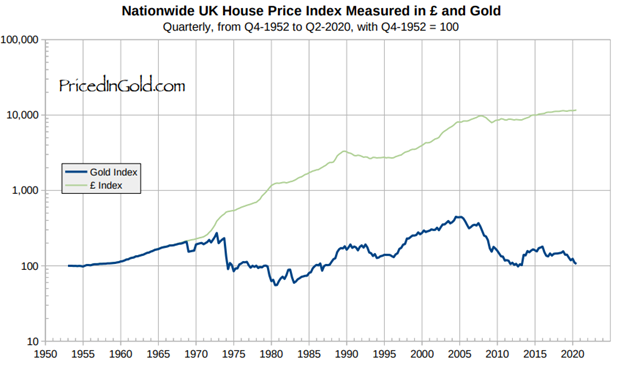

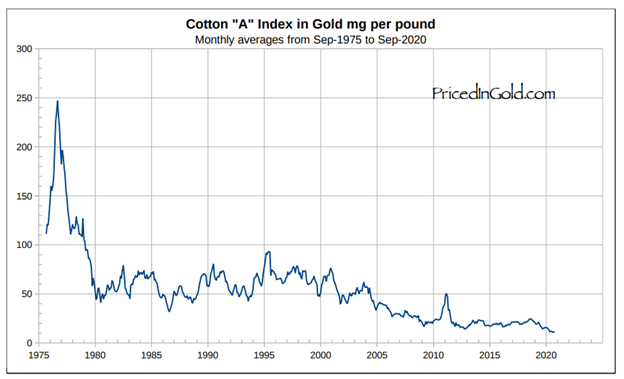

In economic terms, a tide that rises high due to certain factors can also recede in line with those factors changing. Now, I’m not saying that property prices in the UK are going to fall, but I have a strong feeling that they are going to move back into some kind of long-term trendline that correlates better with average incomes, population movements and average household expediture. Back in those days of 8% mortgage rates, the general guide was that a repayment mortgage took up one-third of household income and I believe that is coming again, along with more of the free household income needing to be spent on essentials like food in a time of scarcity and rising prices, rather than frivolities like the next Ryanair trip to Malaga. There are two more factors to take account of – the massive Brexodus of cheap Eastern European labour deciding that they miss the family back home, so perhaps now is the time to take the accumulated savings back to their homelands and invest in a better life there, along with the possible death of millions of old people and the freeing up of their economic resources. Of course, in that scenario, labour shortages are also likely to mean salaries having a large and sudden rise, so the imbalances could just as easily be solved by huge average income rises in a very short space of time. That certainly did not happen in the 1990s, as the UK struggled with trying to keep the value of the Pound to the decreed band with the ERM (European Exchange Rate Mechanism). It was only upon surrendering that with a massive wealth transfer from average British citizens to George Soros, that the economy was seen to be moving up again. Years later I see it for what it really was – smoke and mirrors of an inflationary nature.

As a footnote, I dreamt about Eastbourne a couple of months ago and that helped this memory resurface. Ah how I loved that town. Whereas Brighton was rowdy, crowded and cosmopolitan, Eastbourne felt genteel, quiet and still with traces of the pre-war seaside glamour of the 1930s that the Art Deco railway posters bring to mind. It had a fantastic restored Art Deco tea room right on the seafront, where the maitre’d ensured everything was conducted in line with the era, and, if I was lucky with the timing, someone would play suitable tunes on a piano in the background while you partook of tea and scones. For a few moments you could imagine you were in an Agatha Christie Poirot story, and that when you asked for the bill, it would come back to you priced in shillings and pence. Afterwards, I’d take a walk back along the promenade to the pier, then up to the town centre and visit the fine old Art Deco department store buildings of the Co-op and Debenhams, both now defunct.

Yes, change always happens and more change is coming. Not least when we think again of the World Economic Forum’s Welcome to 2030 : You will own nothing and you WILL be happy. Perhaps then, the question of whether we buy or not is irrelevant, only survival will matter?