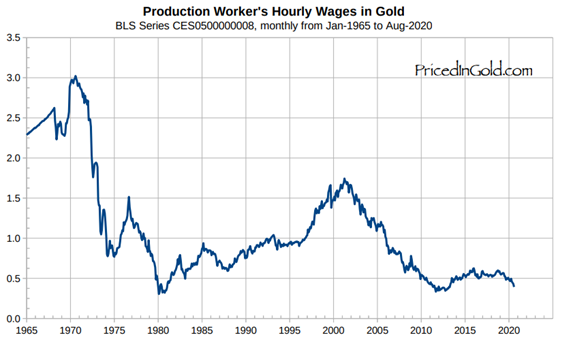

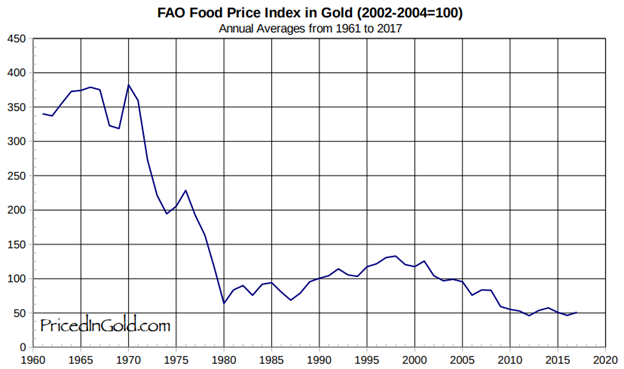

100 years ago, the average household spent up to 50% of its income on food. Today, that figure is nearer 10%, giving us all more disposable income for consumer goods, bigger mortgage repayments, and exotic holidays. Food is cheap, almost too cheap, in fact. As some farmers struggle to turn a profit and big supermarkets control the supply chain.

(Chart showing food prices as a proportion of income)

Of course, some of this is due to technological improvements in farming and manufacturing, but much of it is due to fiat currency inflation versus gold. Perhaps it can’t last forever – we may well already be being prepared for future food shortages and increases in food prices. You may have already noticed shortages during the crisis or increases. On a personal level, visiting the supermarket regularly, a 20-25% increase in fruit, vegetables, and dairy products has occurred since March 2020, when Corona began. That’s interesting, as these products are all the ones with the shortest shelf life, that are most immediately impacted by price rises. Others, like dried, tinned and frozen goods, may be in huge stock at warehouses down the supply chain behind the supermarket facade, and price rises may take longer to feed through. Observe these headlines from recent times, as to what they may be planting the seed in your head to germinate for:-

“UK potato farmers fear another washout for this year’s crop. “

The Guardian, August 2020

“Bread price may rise after dire UK wheat Harvest.”

BBC News, August 2020

“Coronavirus: Meat shortage leaves US farmers with ‘mind-blowing’ choice.”

BBC News, May 2020

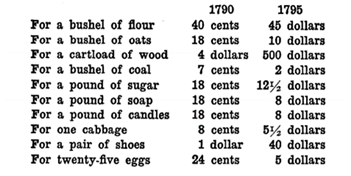

If you wonder how far food prices can rise during a monetary crisis, then here is an example of prices from “Fiat Money Inflation in France,” an excellent study of the hyperinflation that occurred there during the French revolutionary times, which coincide with the decline of the French empire before the handover to Great Britain.

Now, how well covered are you for those kinds of price rises in basic commodities, the essentials of life?