About 30 years ago, an enjoyable computer game appeared on the market that allowed you to run a city exactly the way you wanted it, allocating zones as residential or industrial, then building infrastructure such as power stations, roads and railways. As I recall, the success in the game was measured by the growth of your cityscape and the amount of taxes collected. It was called SimCity.

Now, amusing as it was, fast forward 30 years and it becomes clear that either someone played that game and decided that the real world could be structured the same way, or, the whole point of the game was to condition a certain type of thinking in people that things being decided by higher powers was good and that taxes were good. I can’t agree with either of those last two prepositions and as a result, I gave up on the game pretty quickly. I even felt some strange guilt as I flattened a developed residential zone and thought about those imaginary SIMulated citizens, the lives they’d built and the dreams they had, which I’d just crushed with my belief that I somehow knew better.

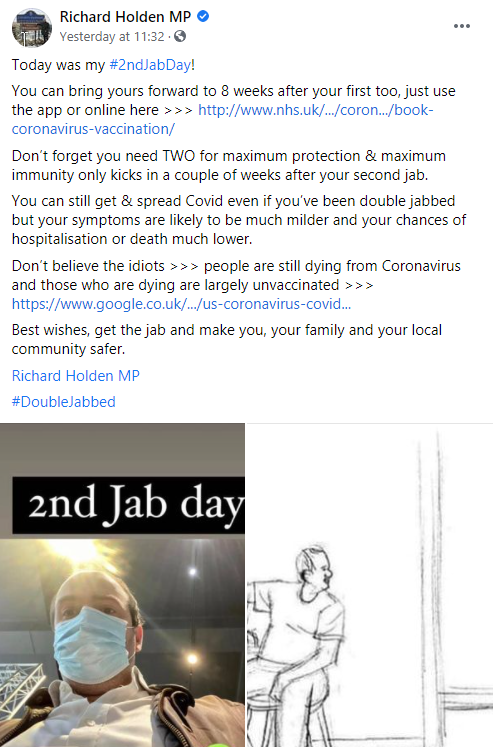

Looking back, it’s clear that the game could be viewed as some kind of psychology test for world improvers. I’d bet, for example, that most politicans were fans. Take Justin “trendy” Trudeau, for example. Yes, please, take him. Every time I see him now, I see a child who probably played SimCity incessantly, never stopping and maybe even having discussions with his Dad (Fidel, or Pierre, take your pick) to analyse where he’d gone wrong so he could be a better world improver when he grew up. For sure, to be a politician now means that you really do not see the people you are supposed to represent as valid human beings, just commodities that can be swept off the table or electronically deleted to suit your higher purposes. Take Richard Holden, ConSelfServative MP for Northwest Durham and his recent Facebook tirade that people refusing the COVID-19 vaccine are idiots. Part of me senses he knows he may not be needing their votes ever again in a future general election, so his true colours about not even seeing them as valid people is revealed. Either because they won’t be able to vote, or an election will not be happening.

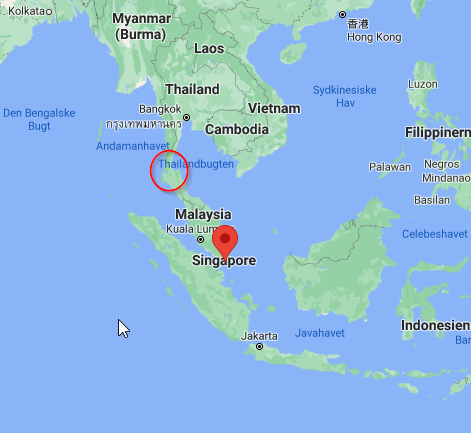

So, how might a real-life Sim City work? Well, you’d certainly need a lot of technology to make it happen, wouldn’t you? A reliable, high-speed internet network that could monitor the success or failure of each zone and the infrastructure you were building. Like 5G, perhaps? Only a conspiracy theorist would think that though, because of course the 5G infrastructure investment has continued unabated during a time people were supposed to be in lockdown and it’s all so we can have faster internet to call the overworked NHS or watch Netflix*, isn’t it? Secondly, what measurements of real-life success would you use…happiness..probably no…financial, probably yes. So if we measure every life in those terms, it fits entirely with the elimination of low-economic activity generating pensioners and not really caring about how people are doing as long as the tax revenues are up. Depression could go through the roof and be seen as positive for economic activity, as long as those SIMs are buying their meds and still paying their taxes.

This leads to the third question – how do you get those SIMs to undertake what you want to do without protest, or at least too much protest and still continue to have them as productive citizens – productive on your terms where you get to take a cut of their productivity through taxes, anyway? As I get older, I become more and more aware the SIM city-style planning that was carried out on my own doorstep in the 1940s to the present day. Let’s begin by looking at World War 2, for example, and ask if someone looked at a map and thought it rather inefficient that much of Europe overlapped with unworkable borders, where whole regions were comprised of villages and towns where one might be 90%, say, German, then the next, say, 90% Polish. These people co-existed side-by-side and traded and often intermarried, but the barriers of language, culture and patriotism might lead a high level world improver to wonder how you could, well, improve things. Of course, you couldn’t take the map, draw your preferred line, then get these people to move, so it’d take something serious like a war with mass death and displacement to make it happen. Which is what did happen, along with the destruction of huge residential areas, now converted back to wilderness or industrial zones.

You may or not agree with me, but in the 1950s, Durham County council drew a categorised list of every town and village in the County as being A, B, C or D, with D meaning the village was not have any money spent on it and that the residents would be encouraged, by neglect and closure of key facilities, to move. Sim City planning at it’s finest, since the residents themselves were never told this was going on until people found out many, many years later. My grandparents own village was categorised as D. It still exists now, as it got swallowed up by urbanisation and has become quite a desirable place to live. If anything, this shows the failure of centralised planning compared to a free market.

Then we have city centre planning in Newcastle in the 60s and 70s. I sat in the car with my Dad in the 1970s and drove past rows and rows of empty Victorian terraced houses in Scotswood, Newcastle, scheduled for demolition following compulsory purchase and removal of the residents. Many of whom had lived there for generations. Again, human emotion, attachment and community means nothing to the average, yet very dangerous, central planner. Just cold hard credits. The real legacy of these central planners was not just the destruction of the communities, but the building of horrific tower blocks of low, low quality, followed by the exposed corruption of central planners like T. Dan Smith and the demolition of many of these blocks in subsequent years. Incidentally, the young me watched a cartoon called Mary, Mungo and Midge about living in one of these tower blocks that were being built at breakneck speed across the country, that I’d now see as brainwashing for children of what a better centrally-planned future is going to be.

So, what about the future, how might you control your SIMs? I think we all got a little insight into it about 6 weeks ago, without even realising it. Picture the scene I am about to describe as akin to as something from a James Bond film. The evil arch-villain sits on a swivel armchair in front of a large screen with a major public event taking place. He demonstrates his power at the press of a button and the result is available for all the others attending the video conference to see. The arch-villain (let’s call him Swabia, for no reason in particular), then swivels on his chair to face the other video conference attendees, stroking the cat on his knee and says confidently, in guttural English – “…well, gentlemen, you have now seen the power of our new technology, are you not impressed?”. The other attendees are impressed and shocked at the power of what they just saw and then the bidding, or negotiations for the coming power divide begin.

What event am I talking about? Well, the collapse of Christian Eriksen in the Euro 21 opening game in Copenhagen. It was unlike anything I have ever seen in my 40 years of watching football matches and especially not for a world superstar, primed to sporting readiness for this tournament. What’s interesting is that tweets did come out saying Eriksen had had his COVID-19 “vaccine” in May. Danish media were all quick to dismiss this, without actually saying at any point that he had not had the injection. This probably says a lot about the quality of media and journalism, no desire to track down the truth, or if the truth has been tracked down, pass it onto their readers. Subsequently, doctors have no idea what happened to Eriksen that night, he’s now fine, but they’ve fitted a pacemaker anyway (perhaps he should’ve said no to that) and it’s debatable whether he’ll ever play top level football again. Now, imagine if you had the power to exterminate SIMs who were past their use-by date, say, the old ones, or make people ill in residential areas that you wished to convert to industrial or run a new piece of infrastructure like a road or railway line through – on this basis it’s a very useful technology to have. SimCity is no longer a game, but becomes real-life.

Come to think of it, the city of the future may also be a Simp City, given the decline in testosterone and increase in oestrogen levels in men recorded these past years. Something to talk about another day.

As an aside, I cancelled Netflix about 6 years ago and I’m never going back. Not only is it a lot of mind-programming, I cannot tolerate TV series of more than, say, 6 episodes and no defined end. I haven’t even watched BBC since Christmas 2020.