We have seen and continue to witness a massive growth in the value of certain corporations to the extent that their market capitalisations are greater than the GDP of many nations. With that kind of power to wield, corporate currencies are bound to be offered more and more. It’s not necessarily a bad thing, just as long as people know what they are and, most importantly – have options to use them or not. For example, at the beginning of September 2020, Apple’s Market Capitalisation hit the same level as the whole UK FTSE-100, the leading 100 companies in the United Kingdom. These corporations are now huge.

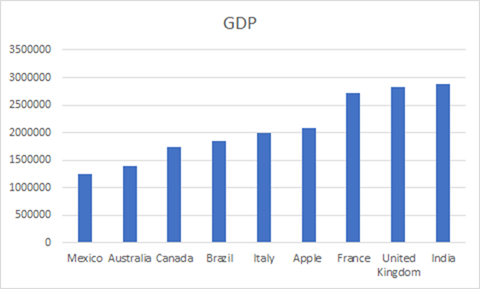

Market Cap of Apple versus 2019 GDP for selected nations

Now, bear in mind that just a few years ago, Apple was just above Mexico. So the trend is upward, then consider many nations are now forecasting a 2020 GDP slump of 10% or more. Apple may even be above the United Kingdom GDP before too long, perhaps even the end of this year.