The British Empire and Sir Stanford Raffles in particular were a very shrewd lot. They identified a seemingly irrelevant island with a population of about 150 people as a piece of prime real estate back in 1817. What’s happened since is well-known of course, as the city of Singapore has developed into a major international trade and financial hub, with all the wealth and status that goes alongside that.

This place had always been on my to do list, so when a work trip in 2018 presented me with the opportunity for a one day stopover, I took it with both hands. While I didn’t actually sit down for a Singapore Sling, I did take a wander around the Raffles hotel complex and see the art deco railway station, where bullet damage from the 1941 Japanese invasion was still visible in some of the outer walls, before it probably disappears as the city modernises even further and obliterates the British symbols. The railway itself has already been moved to the North of the island and the future of the station seemed uncertain then, but ghosts were visible everywhere, as I peered through the locked gate into the past, surrounded by modern skyscrapers. I also saw the 1920s post office building, now a hotel, the main square in front of the Town hall where hundreds of thousands were executed by the Japanese and one of the world’s most expensive pieces of undeveloped real estate, The Singapore Cricket Club. I can only wonder how much longer that last piece of Imperial history will last. The battle of Singapore itself in 1941 has always fascinated me. For obvious reasons, it does not feature large in British history when World War 2 is mentioned, but will probably forever be Britain’s biggest military defeat, with a loss of 100,000 military personnel into Japanese captivity and subsequent death, along with the loss of two Battleships – The Prince of Wales and The Repulse.

I’d love to revisit some day on less of an intense schedule, but I sense my days of travel are numbered and I’ve used most of those numbers up. No matter, at least I can say I saw some of the world before all prison doors were locked with a resounding thud.

At the time, I was not ignorant of the island’s position as a major trade route and centre of wealth. Goldmoney and Bullionvault have offered Singapore as a precious metals storage location for years. However, it’s only when you are actually there on the ground, staring up at the impressive skyscrapers that you really understand how the wealth and energy is migrating from the old world to the new.

It’s interesting how stories coincide once more and get you thinking on a particular route. A few weeks ago, I expressed the view that Bitcoin is a distraction, or a preparation for a release of a new monetary system to replace the Petrodollar that has existed since 1971, the year of my birth, the introduction of decimalisation to the UK, the closing of the Gold Convertibility window in the USA and the official founding of the World Economic Forum – more on the last one later. In my view, the coming of digital currencies is inevitable and they may not be nice, with features such as time limitation (spend it or lose it) and extra credits available only to those who follow the rules of society (get the jab or don’t eat meat?). However, for them to be truly accepted, they will need to engineer a collapse of the current system and when that system collapses, every monetary system change ever has had to promise some kind of gold backing to get the public onside.

Historically, the old world still rules the precious metals world, with familiar locations like New York, London and Switzerland being where most of that trade is transacted. As the old world declines further and the new world rises, an Asian powerhouse, one with independence, strong defences, good shipping links and a robust financial system to trade gold and silver is required. There’s no doubt on these metrics that Singapore ticks all the boxes.

What really triggered it was a story mentioning the huge new precious metals facilities being developed in Singapore. It’s not the first time media, including the BBC, have reported on this. Yes, it looks possible a new world currency backed by gold/silver is coming and it will all be stored in Singapore, perhaps with an offshoot for Europe in London. On this, Brexit suddenly makes more sense – a European nation outside EU control, a defendable island where the wealth can be stored as the mainland descends into destruction. The Corporation of London certainly has a pedigree line of survival and growth, regardless of the general situation in the country. You may laugh, but despite a recent short period of comparative peace, Europe has a long, long history of huge wars for resources and after a year of rewarding people for doing nothing, while the continent becomes ever-more dependent on a few producers to carry the mass on their shoulders cracks may appear and Atlas may yet shrug.

When you think about it, it’s interesting how Switzerland always managed to remain neutral during the many European wars of the last few centuries. It becomes clearer why when you are aware of the high levels of banking secrecy Switzerland has historically maintained regarding account holders and fund sources. Consider also how much plundered loot found its way to Switzerland during World War 2. Why, the World Economic Forum itself is even based in Switzerland and Klaus Schwab, it’s apparent founder, was born in Germany in 1938, just before World War 2 began. I’d be interested to learn more on his family history, and this article is something of a primer. Having conducted their meetings in Davos, Switzerland for the entire history of the organisation, they are now holding their first-ever meeting in Singapore in August, 2021.

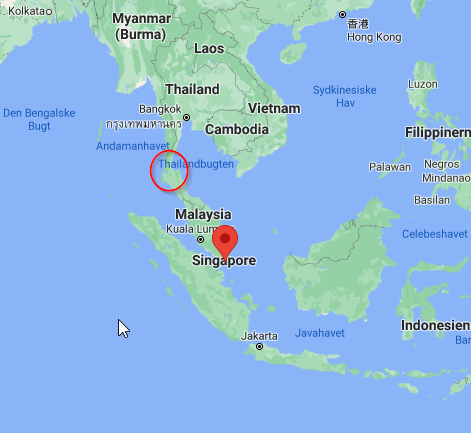

On closer examination of the Asian map, Singapore is crucial to all trade heading from China, Japan and Korea etc to India then onwards to Europe. Ships can only sail through one narrow strait. The Evergreen in the Suez canal feels like the first visible supply disruption which will expose Europe to how reliant it has become on foreign imports of essentials. Perhaps when those containers do finally arrive, they will be loaded up with precious metals for the return trip as Europe is stripped bare?

Meanwhile, almost everyone in Europe wanders around like idiots, wearing masks and continuing to following “official advice”, not laws on all kinds of things that really are basic human rights, like seeing family and friends, or conducting mutally beneficial transactions with other human beings. Blithely unaware of the probable imminent end of their way of life. You know, that “way of life” that you have been told terrorists hated so much that it needed to be protected, yet was immediately signed away the moment you got told a new virus with a 99.6% survival rate hit?

What do I know really? If I was better at these things I wouldn’t be working in an office following the limitations of my school programming, but on the basis of these jigsaw pieces slotting together, perhaps we should be investing in Singapore. Especially banks if it is going to be the new Switzerland after the World Economic Forum meeting. Not to say there won’t be bumps along the way – one other thing about that map is the seeming inevitability of a conflict between the old world powers and the new. That same Asian map shows how China is totally hemmed in from the sea because the USA controls Japan, South Korea, Taiwan and the Philippines. If China could punch through and take Taiwan or part of the Phillipines, they could control the Pacific. A war is brewing. I note, for example, that the UK recently sent their aircraft carrier to the China sea. A war in which Singapore will remain an agreed neutral by all parties, just like Switzerland did during the last century, but a war in which the destruction and rewards to the victors may well be huge and end up on this small island nation.