“Some men just want to watch the world burn.” – Alfred Pennyworth, The Dark Knight (Batman)

If I was to construct a plan with the final objective of watching the world burn, I wouldn’t know where to start, but some people clearly do. For, since March 2020, you couldn’t have introduced a better set of policies to achieve this and worse, the majority of people are going along with it without realising the final endgame and the consequences for them and their way of life.

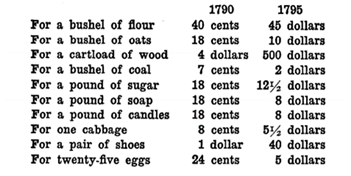

The main thing that triggered this post has been the recent 50% increase in electricity prices here, followed by an email telling me the price of my wood pellets for heating was going up 10%, followed by another email one month later telling me that…the price is going up another 10% due to increasing raw materials, manufacturing and transport costs. You could not get a clearer message that survival is the future name of the game and soon it won’t be worth working, not at the current rates of pay, at least and time will be best spent fighting for the remaining toilet rolls on the supermarket shelves at any price. Welcome back to the 1970s, a time of shortages, conflicts, stagflation, stock market crashes and inflation. Unless things change, expect the same once more for a new generation, only greatly amplified due to globalisation and the loss of local self-reliance. I myself have clear memories of my mother making hotpot using the electric cooker in the allocated 4 hours of rationed electricity time, in the UK and sitting with candles on dark (k)nights. Oh how it was kind of fun as a child and besides, with a TV with only 2 or 3 channels to choose from and no internet, technology was not so missed as it would be today. Can you imagine the freaking out for many, if the mobile phone goes flat and it cannot be recharged?

So, let’s look at some of the ways the world is burning. Advance warning – in some cases, it really is, literally :-

Paying productive people to stay at home and do nothing, rather than contribute, or worse, paying them to do unproductive tasks like PCR testing (possibly, this is destructive, but let’s leave that for another day). All the while, increasing the taxation and debt burden on the shrinking productive sector. For yes, furlough still exists, paying people close to full salaries to stay at home and do nothing, while the better employees get paid the same and are required to actually go to work and carry the load of two people.

Telling businesses to not let in particular customers, or lock down completely and suffer the consequences. You’ve probably seen those consequences on your very own High street, where many businesses have closed down completely? Certainly, even if some did not go bust, many owners seem to have decided it’s a good time to retire. It would have been nice to see more businesses resist, like the hairdressers in Bradford who stayed open throughout and accumulated over £18,000 of illegally-issued fines, which recently got written off. Common Law and Maritime law are worthy of additional study, if we are to survive.

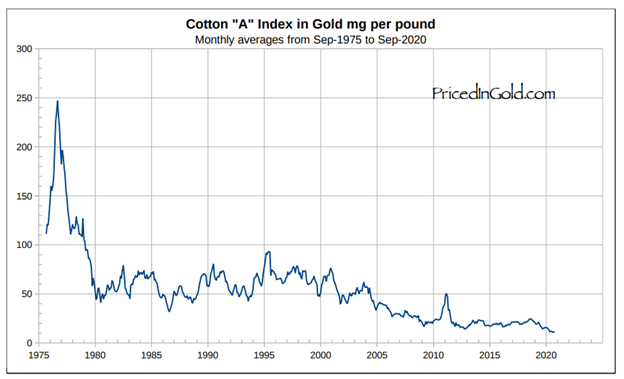

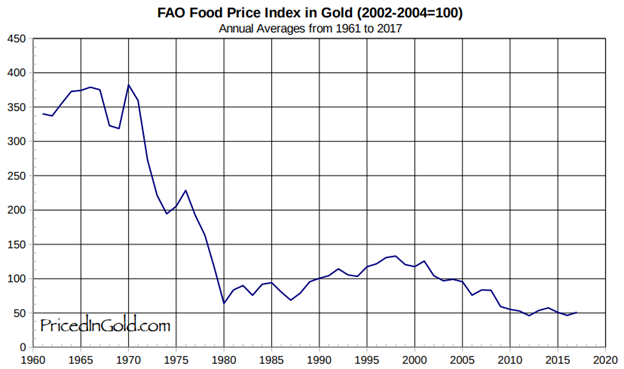

Ordering farmers to burn or destroy crops instead of allowing them to reach the free markets and reduce rising prices. Every food commodity is going up in price, just look at corn and beef, for example.

Emptying reservoirs at a key time. This one is a worldwide occurrence when you start looking, and has left many, such as California farmers, puzzled as to why their fields stand barren and unproductive while water is, quite literally, flushed down the drain.

After years of simply burning excess natural gas into the atmosphere, it’s become the new hot commodity. Perhaps next time someone tells you that you are responsible for the global warming con, you should picture this burning that’s been going on for years. Natural gas prices are now up over five times in just a few months. It could have been eased had the pipeline from Russia had been allowed into Western Europe, but again, interference with perhaps darker motives has played a part. Natural gas isn’t just used for heating homes and generating electricity, it is one of the main components of fertiliser production, so expect this to feed into higher food prices too.

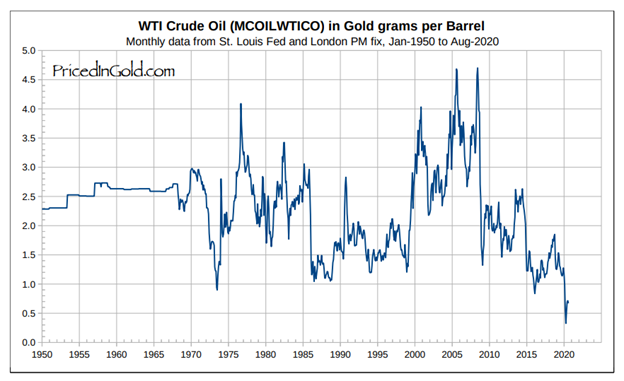

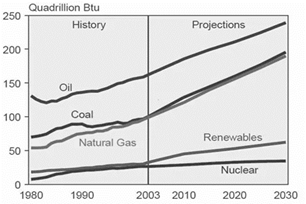

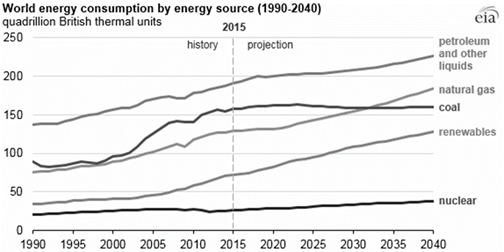

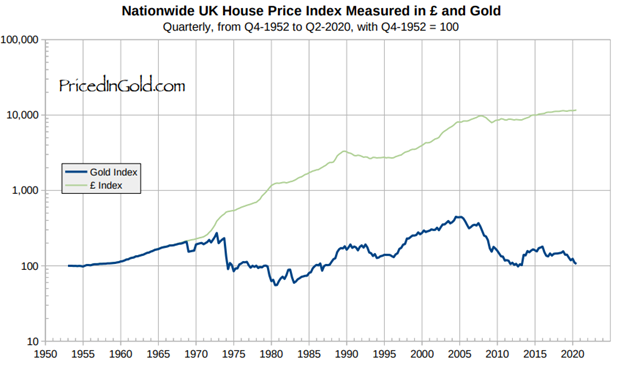

Starving traditional energy production of finance – you must’ve heard the awful ESG stamp on some investing funds, promising not to invest in dirty businesses. Define dirty. I note the influential Blackrock in the USA made promises here. Here’s some financial musing – think of completely avoiding any fund with ESG compliance and buy funds that unashamedly invest in oil, coal and essential resources – the world needs them and will continue to do so for a long, long time. In fact, the IT sector knows this and the cynic within me wonders if the gigantic predicted increases in power consumption forecasted for the next 20-30 years are due to increased IT usage for the mega-servers of the internet of things. The secondary cynic also wonders how well those ESG funds will perform in the coming years, when it comes to the pensions of the masses. I bet the investment bank fees are good though and, for sure, when you collect your meagre pension they will console you by saying you invested to save the planet. Shame you’re starving to death because your pension has been stolen from you, but hey?

The U.K. quite cleverly introduced a new legal grade of petrol in September 2021, with twice as much ethanol in it as before. They also introduced a very clever temporary shortage to clear the garage tanks of the old petrol, so the new grade could be rolled out. Okay, perhaps my cynical brain is in full flow today, but it’s hard not to be with stories like this. How is the ethanol produced? From corn, of course, so this new petrol puts even more pressure on food prices. Worse still, some older cars may end up with damaged engines from this new petrol grade and be fit only for the scrapheap. While getting older cars off the road is often touted as being good for the environment, don’t forget the gigantic manufacturing and transportation costs, or the estimated 500,000 litres of clean water used for every car produced.

By now, you should be aware that you are under attack from all directions and you’re probably wondering what you can do to counter some of this. I have often placed stock upon Zigging while the World Zags. In a time where people are spending more and more time in the virtual, meta world, you could probably not do much better than go out into the woods and hug a tree. After all, when was the last time you experienced a real hug, one with energy and genuine love? I’m not joking either, I personally am making major steps to more frequently let the mobile phone go flat – at the very least it’d be interesting to see what happens if I do once the covid passport is mandatory. Yes, once. Do – talk to people (or trees), read books, write with a pen and paper, meditate and listen to the birds sing. Don’t – watch TV (there’s a reason it’s called TV programming), subscribe to Netflix, read newspapers or drive when you could walk. Feeding the machine with your energy cannot be a good thing. Of course, there are some things I cannot overcome yet, such as working in IT and writing this electronically, but there again, put your supposed carbon footprint into the context of those items above and realise it’s not your fault, or that of the neighbour you are being encouraged to hate.

As a final thought, in reverse Sumerian Gematria, Batman equates to 666…